Forex trading, short for foreign exchange trading, is the global marketplace for buying and selling currency pairs. With a daily trading volume exceeding $6.6 trillion (as per BIS 2019 report), it’s the largest and most liquid financial market in the world. This growing interest in Forex Trading stems from its accessibility, flexibility, and opportunities for potential profit. Below, we break down the key aspects of forex trading to help you understand its fundamentals.

What is Forex Trading?

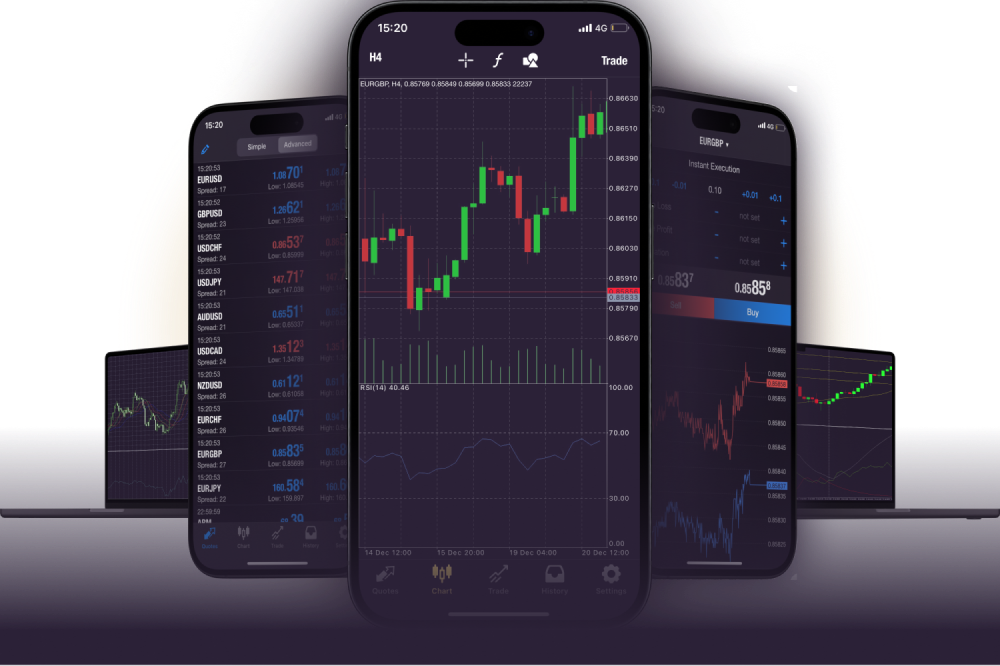

Forex trading involves exchanging one currency for another with the goal of profiting from changes in exchange rates. Currencies, like the US dollar (USD), Euro (EUR), or Japanese yen (JPY), are traded in pairs (e.g., EUR/USD). This means you are simultaneously buying one currency while selling another.

Forex trading occurs in a decentralized market, operating 24 hours a day across major financial hubs like London, New York, and Tokyo. This allows traders to engage in the market at any time, making it a flexible option for investors worldwide.

How Forex Trading Works

Currency Pairs

Forex trading revolves around currency pairs, categorized into three groups:

•Major pairs (e.g., EUR/USD, USD/JPY): Highly traded, involving the world’s most stable currencies.

•Minor pairs (e.g., EUR/GBP, AUD/JPY): Less traded but include significant currencies without the US dollar.

•Exotic pairs (e.g., USD/TRY, EUR/ZAR): Pairings between major currencies and one from an emerging economy.

Leverage and Margin

One of the defining features of forex trading is leverage, which allows traders to control large positions with a small initial investment. For example, a leverage of 1:50 means you can trade $50,000 with only $1,000 in your account. While leverage amplifies potential gains, it also increases risk, so it must be used with caution.

Bid-Ask Spread

The profitability of forex trades relies on the bid (buying price) and ask (selling price) spread. A tighter spread typically benefits traders by reducing transaction costs.

Why is Forex Trading Popular?

Forex trading attracts diverse participants, from individual day traders to financial institutions, due to its unique advantages:

•High Liquidity ensures efficient trade execution with minimal slippage.

•Flexible Hours accommodate traders in different time zones.

•Low Barriers to Entry make it accessible, with some brokers offering accounts for as little as $100.

Final Thoughts

Forex trading offers immense potential for profit but comes with significant risks. Education, strategic planning, and disciplined risk management are essential for success. Whether you’re a novice or an aspiring trader, understanding the mechanics of forex trading is the first step towards navigating this dynamic market.